Post-Recession Small Business Forecast is Green: More Small Business Owners See Economic Conditions in U.S. Improving; Owners See Growth Potential in Energy-related Industries

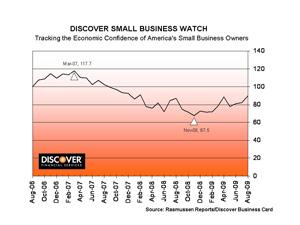

Economic confidence among small business owners jumped to its highest level in 18 months in August as more owners expressed faith that the U.S. economy is on the rise and gave signs that they are more willing to invest in advertising and new inventory, according to the latest Discover® Small Business WatchSM. The index rose to 89.8, up 7.7 points from July and the highest level since 90.9 in February 2008.

“For the past few months, small business owners have shown rising confidence in the overall economy, as well as an increasing sense that the conditions for their own businesses are improving,” said Ryan Scully, director of Discover’s business credit card. “This month we have a few more signs that they may be ready to start trying to grow their businesses again, and that the worst may be over.”

August Highlights:

- The number of small business owners who think the economy is getting worse dropped to 43 percent in August, the lowest reading on that data point since the Watch’s inception exactly three years ago. This month, 38 percent of owners say the economy is getting better, up from 30 percent in July; 15 percent believe that the economy is staying the same, down from 16 percent in July; and 4 percent remain unsure.

- 48 percent of small business owners rate the economy as poor, which is the lowest percentage since February 2008, while 41 percent rate it fair and 9 percent say it is excellent or good.

- 30 percent of small business owners see economic conditions for their businesses improving, up from 29 percent in July; 44 percent see their own conditions getting worse, down from 46 percent in July; and 23 percent say the climate is unchanged.

- 27 percent of small business owners say they plan to increase spending on business development, such as advertising, inventory and capital expenditures, which is up from 23 percent in July; 43 percent plan to decrease spending, down from 49 percent in July; 25 percent are planning no changes; and 5 percent aren’t sure.

- 51 percent of owners say they have experienced cash flow issues in the past 90 days, down from 53 percent in July.

Small Business Owners See Green Growth in Recovery

In a post-recession recovery, small business owners say so-called “green” industries show potential for growth opportunities, but few are employing green tactics in ways that help their bottom lines.

“When entrepreneurs look for opportunities in the post-recession economy, they see the most potential in green industries, technology, energy and business services,” Scully said. “On the other hand, we see less excitement around business segments such as manufacturing, financial services, retail and food service as avenues for growth.”

Highlights:

- When asked to choose from a list of business segments with the best opportunity for growth, small business owners said they see the most potential in the following areas:

- Green Industries, 13 percent

- Business Services, 10 percent

- Energy, 9 percent

- Technology, 9 percent

- Financial Services, 8 percent

- Food Service & Restaurants, 6 percent

- Manufacturing, 5 percent

- Retail, 4 percent

- Transportation, 2 percent

- Not sure, 35 percent

- When asked to select from a list of business segments with the least opportunity for growth, owners made the following choices:

- Manufacturing, 18 percent

- Financial Services, 15 percent

- Food Service & Restaurants, 10 percent

- Retail, 10 percent

- Business Services, 9 percent

- Energy, 6 percent

- Green Industries, 4 percent

- Transportation, 2 percent

- Technology, 1 percent

- Not sure, 24 percent

- Nearly half of small business owners, 48 percent, say that green industries have no impact on their business, while 30 percent say green industries hurt their business and 20 percent say they help.

- When asked which green industries could help their businesses the most, 18 percent chose alternative fuels, followed by energy conservation, 11 percent; recycling, 9 percent; and solar power, wind power, transportation, and water conservation each received 4 percent of the vote. However, this issue has a high degree of uncertainty as 46 percent said they were “not sure” which of these industries could help them the most.

When it comes to going green themselves, 71 percent of small business owners have not instituted any green measures in the past year that have helped profits. Of the 21 percent who did use such applications, 49 percent said energy conservation had the most significant effect on their bottom lines, followed by alternative fuels, 20 percent, and recycling, 20 percent. Solar power, wind power, water conservation and transportation all garnered less than 5 percent of the vote apiece.

In the next six months, 23 percent of small business owners said they have plans to institute green measures at their businesses, while 65 percent said they don’t and 12 percent weren’t sure.

HEALTH CARE UPDATE: Nearly 40% Weigh in on Health Care Reform

Thirty-nine percent of small business owners said in August that they have contacted their congressional representatives regarding health care legislation currently under consideration.

The views and opinions expressed by small business owners and consumers who participate in the Small Business Watch survey are their own and do not necessarily reflect those of Discover Financial Services or its affiliates.

About the Small Business Watch

The Discover Small Business Watch is a monthly index measuring the relative economic confidence of U.S. small business owners who have less than five employees, a segment that consists of 22 million businesses producing more than a trillion dollars in annual receipts. The Watch is based on a national random survey of 750 small business owners. It is commissioned by Discover Business card, which strives to offer the best business credit card for American small businesses, and is conducted by Rasmussen Reports, LLC (www.rasmussenreports.com), an independent survey research firm. The numeric index is calculated by assigning values to responses to a set of six consistent questions. The base value of the Watch was established at 100.0 based on surveys conducted in August 2006. In addition to generating the index, the Small Business Watch surveys small business owners every month on key issues, and polls 3,000 consumers four times per year to gauge purchasing behavior and attitudes towards small businesses. For past results and survey data, visit www.discovercard.com/business/watch. For information on Discover Business card, visit www.discovercard.com/business.

About Discover

Discover Financial Services (NYSE: DFS) is a leading credit card issuer and electronic payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company operates the Discover card, America’s cash rewards pioneer, and offers student and personal loans, as well as savings products such as certificates of deposit and money market accounts. Its payments businesses consist of Discover Network, with millions of merchant and cash access locations; PULSE, one of the nation’s leading ATM/debit networks; and Diners Club International, a global payments network with acceptance in 185 countries and territories. For more information, visit www.discoverfinancial.com.

Contact:

Jon Drummond

Discover Financial Services

224-405-1888

jondrummond@discover.com

or

Daniel Delson

Robinson Lerer & Montgomery

646-805-2036

dmd@rlmnet.com

Source: Discover Financial Services