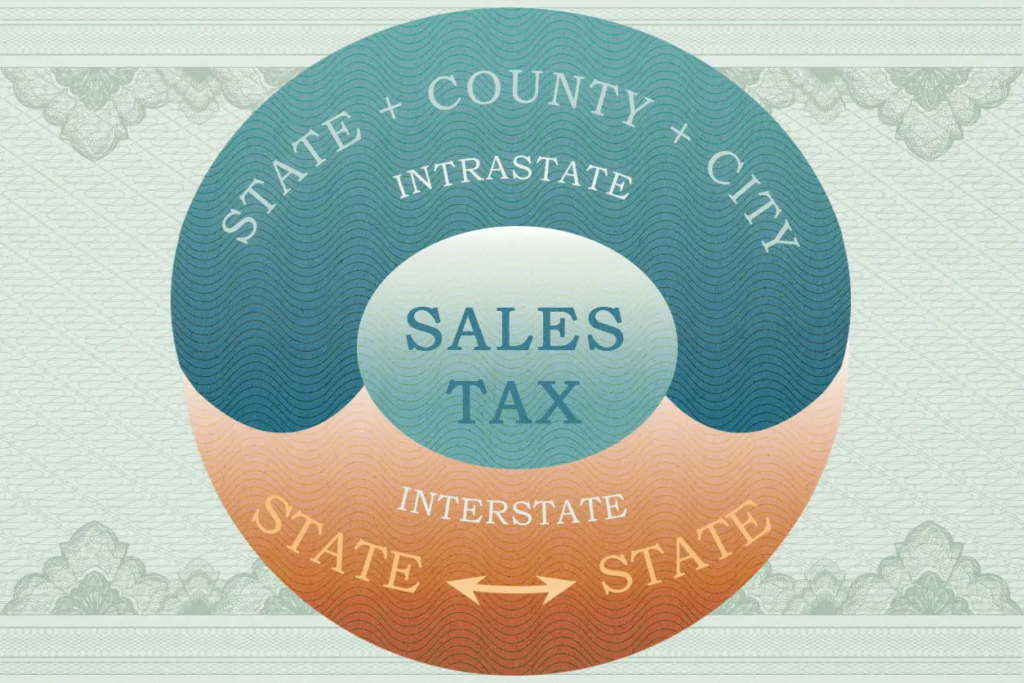

Working out what sales tax to collect from your customers can get complicated. Sales tax obligations change depending on whether you are making a sale in your store, or if you are shipping goods to another location within your state or out of state locations.

Sales tax calculated on store sales is easy because all sales are taxed with the same amount. Out-of-state sales can get a bit more complicated if you have a nexus in the state you are sending the goods or services to. However, most small businesses don’t need to worry about sales tax on out-of-state sales.

In-state sales can often be the most complicated to work out because you must determine how your state levies tax. There are two types of in-state taxation, destination-based or origin-based. TRUiC

If you are already scratching your head at this point, it is good to know that there are quite a few reliable sales tax calculators you can rely on online. The TRUiC sales tax calculator is one of the easy online tools that is invaluable for calculating sales tax. Learn how to use it and work out the sales tax correctly for any transaction anywhere in the US. With the zip code or address, you will get the tax rate for the area you are interested in. In the next step, you can calculate the total cost of the product with the sales tax.

Other sales tax calculators available include:

Sales Tax States

The Sales Tax States calculator is an online tool that requires you to enter a zip code, state name, or city name. Once you are redirected to the state or city you need, all you must do is enter the amount before taxes, and it works out the amount of tax due. It also provides the total amount that includes the tax. The pros of the Sales Tax States calculator are that it is a simple, efficient, and fast tool.

Avalara

Avalara was created by a team of tax experts, and they offer a wide range of tax compliance tools. These tools are relevant to small and larger enterprises. Users of the sales tax calculator have the option of providing an address in a city and the state to determine rates, or they can use their current location. A huge pro.

A con for users of Avalara is it doesn’t rely on zip codes. They feel that this may be inaccurate in some counties and cities where there are multiple rates.

TaxJar

TaxJar offers simplified sales tax management solutions, especially for eCommerce businesses. They are a fully remote company with employees across the country. They have an easy to use online sales tax calculator that requires a zip code. The pros of the TaxJar sales tax calculator are that it is easy to use and can also calculate sales tax in Sweden, Slovenia, Slovakia, and the United Kingdom.

Companies that have more complicated sales tax needs, like calculating sale tax with product exemptions, shipping taxability, and sourcing logic can use the API demo available online. Sales tax management and tax filing can also be automated, making your life easier. Try it out with a 30-day free trial offer from TaxJar.

Taxfyle

Taxfyle has a free and easy to use tax calculator to help you calculate all sales tax for your businesses needs. All you need is to enter the zip code and sales. The calculator then adds the rate for the zip code and provides a sales tax total. The pros of Taxfyle are that it also provides a free tax calculator, small business tax calculator and can also track IRS tax refunds and estimated time of arrival.

Good Calculators

The sales tax of sales made anywhere in the U.S. can be calculated on the sales tax calculator of Good Calculators. The pros of the calculator are that it is easy to use and gives instant results. You can ask it to include any local taxes in a state also. The calculator does not require that you have an address or zip code.